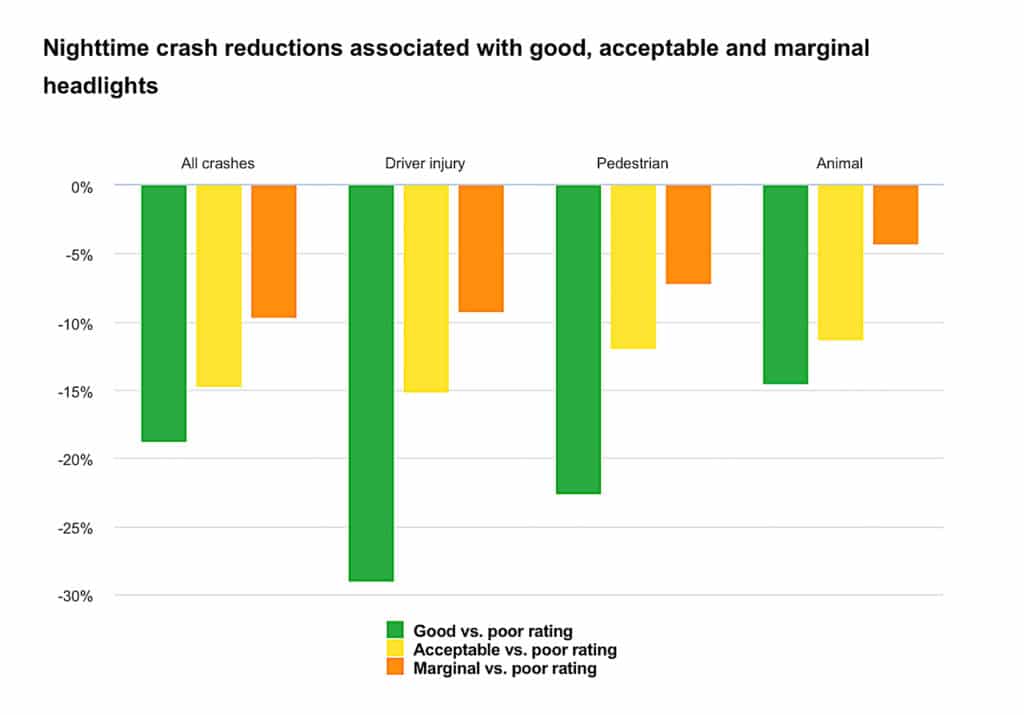

To the surprise of no one, a new study completed by the Insurance Institute for Highway Safety confirmed brighter headlights help reduce vehicle collisions.

The organization noted the number of nighttime vehicle accidents are nearly 20% lower for vehicles with headlights earning a “good” rating in IIHS evaluation, compared with those with “poor” rated headlights. Vehicles IIHS rates as having “acceptable” or “marginal” headlights crash rates are 10% to 15% lower than for those with poor ratings.

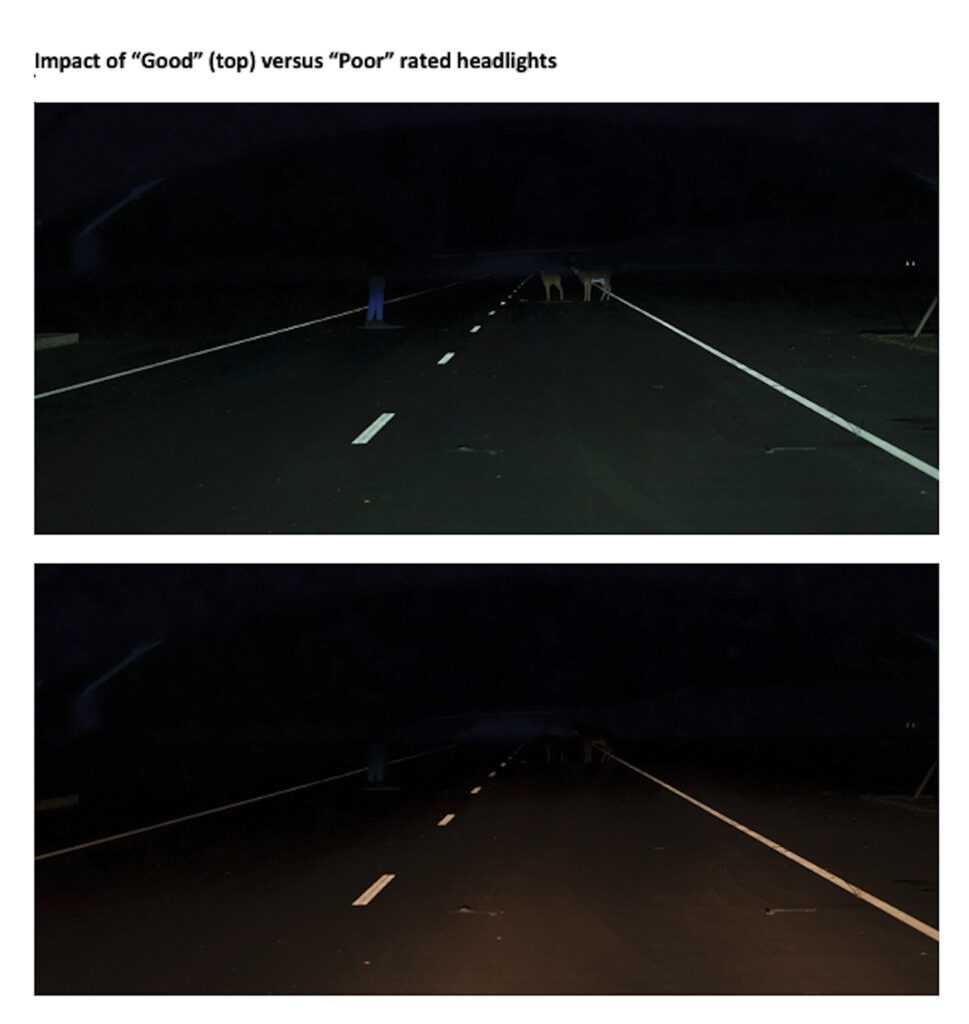

“Driving at night is three times as risky as driving during the day,” said IIHS Senior Research Engineer Matthew Brumbelow, who conducted the study. “This is the first study to document how much headlights that provide better illumination can help.”

An evolving light

Until recently, there was little need to evaluate headlights, as all cars used sealed beam headlights, a technology that became an industry standard by the 1940s. Like the lights in your home, sealed-beam and halogen headlights are incandescent. They use electricity to heat a bulb’s filament, which in turn produces light.

The addition of halogen gas in the 1960s allowed the headlight’s tungsten filament to generate a brighter light that lasted longer. In 1983, the Federal Motor Vehicle Safety Standard was revised, allowing for all composite headlight assemblies to have replacement bulbs. Yet overall, headlights had changed little since electric headlights first appeared on cars in 1898.

That changed with the introduction of high-intensity discharge headlights, or HIDs. These are arc lamps, much like a neon sign, which produce light by the sparking an electrical arc between two conducting electrodes inside the bulb. Far more efficient than halogen lamps, they not only produce more light, but also use less energy and last far longer.

Then, in 2004, the first LED headlights appear on the Audi A8. An LED a semiconductor that emits light when a current is passed through it, using far less energy than other types of bulbs. This led to the creation of LED Matrix headlights, which uses LEDs, sensors and cameras to light the road depending on road conditions. Now, automakers are starting to employ laser lighting, affording 1.25 miles of visibility.

Testing counteracts an outdated federal standard

Given evolving lighting technology, IIHS began evaluating headlight effectiveness in 2016 to counteract the federal government’s outdate lighting standard, one that considered all headlight types equal. The problem is, they’re not. Five years later, IIHS has rated approximately 1,000 different headlights, bestowing them with the same good, acceptable, marginal and poor ratings used for the crash test evaluations.

The IIHS’s new study shows that good-rated reduces driver injuries in crashes by 29% and the rates of tow-away crashes and pedestrian crashes by about 25%.

“Better scores in our headlight tests translate into safer nighttime driving on the road,” said IIHS’s Brumbelow.

Despite the changes in headlight technology, the Federal standard for automotive lighting hasn’t changed significantly since 1968. What’s worse, the standard specifies minimum and maximum brightness for headlights without taking into account how well it is installed. The standard also lacks any regulations for newer technology, such as curve-adaptive headlights.

To address such failings, the IIHS’s evaluation of vehicle lighting are done while driven on a test track. Performance varies considerably; current low beam headlights illuminate anywhere from 125 feet to 460 feet. That’s a difference of as much as 6 seconds when driving at 50 mph. The tests have compelled OEMs to improve the quality of their lighting, IIHS says.

“Our awards have been a huge motivator for automakers to improve their headlights,” Brumbelow says. “Now, with our new study, we have confirmation that these improvements are saving lives.”