Lotus built its last the last Elise, Exige and Evora sports cars today in Hethel, Norfolk, U.K. The end of production for the three sports cars comes as Lotus readies its assembly lines for the upcoming Emira, which is expected to roll off assembly lines in the spring.

“We will miss them, but a bit like Christmas, once it’s over, the excitement for the next one starts to build,” said Russell Carr, design director, Lotus Cars, in a statement. “And that’s what’s happening now at Lotus with the Evija, Emira and forthcoming Type 132. 2022 is going to be a great year as a new Lotus generation swings into action.”

End of an era

During the cars’ 26-year run, 51,738 cars were built. Combined, they represent almost half of the total production of the 73-year history of Lotus. From 1996 to 2000, the first-generation Elise and Exige sports cars were built alongside the Lotus Esprit. But the company revamped its assembly operations when the Spirit ended production. Now, the current assembly lines will be dismantled and revamped, allowing for an addition 5,000 units of capacity.

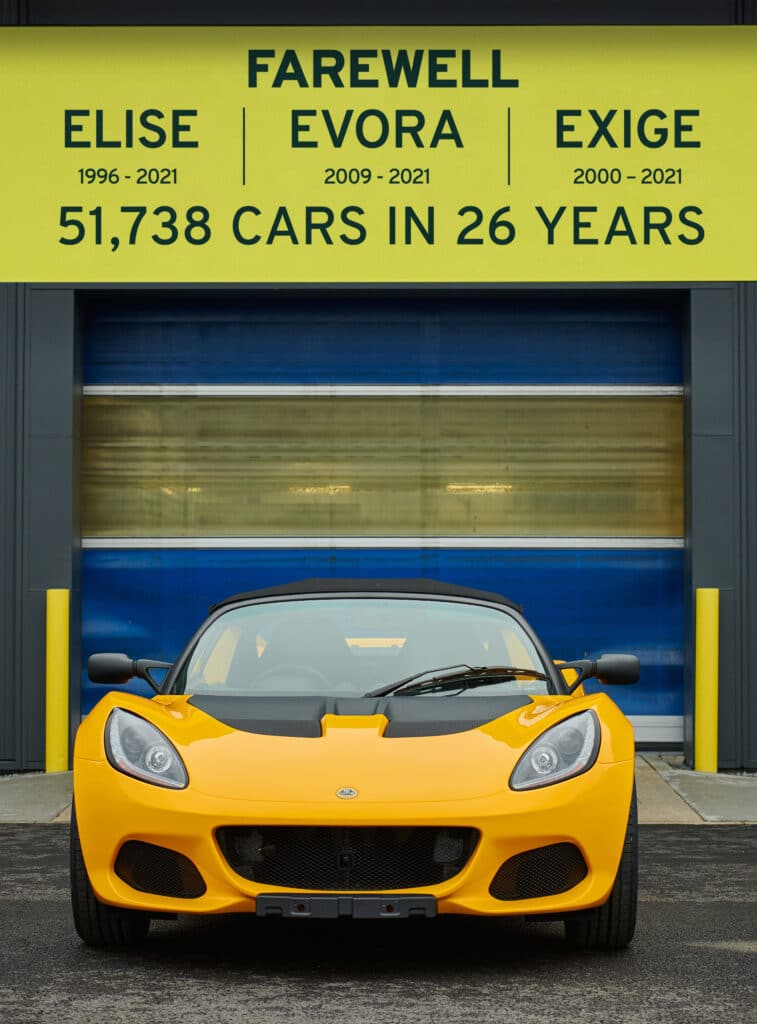

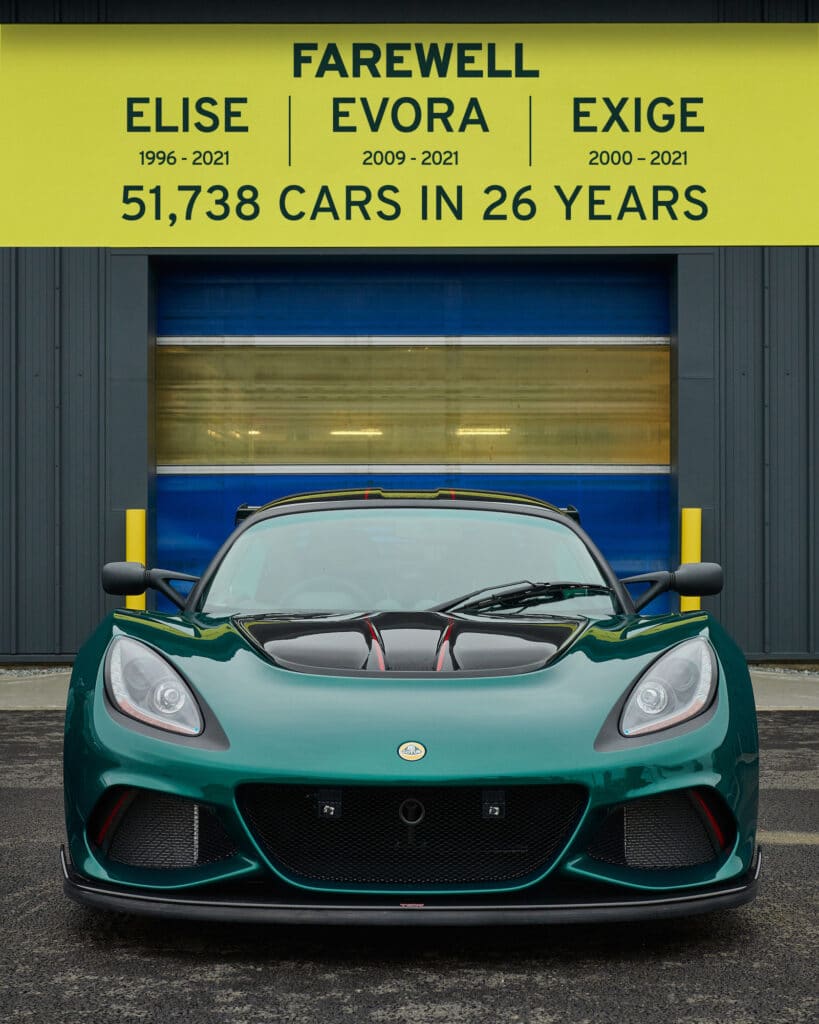

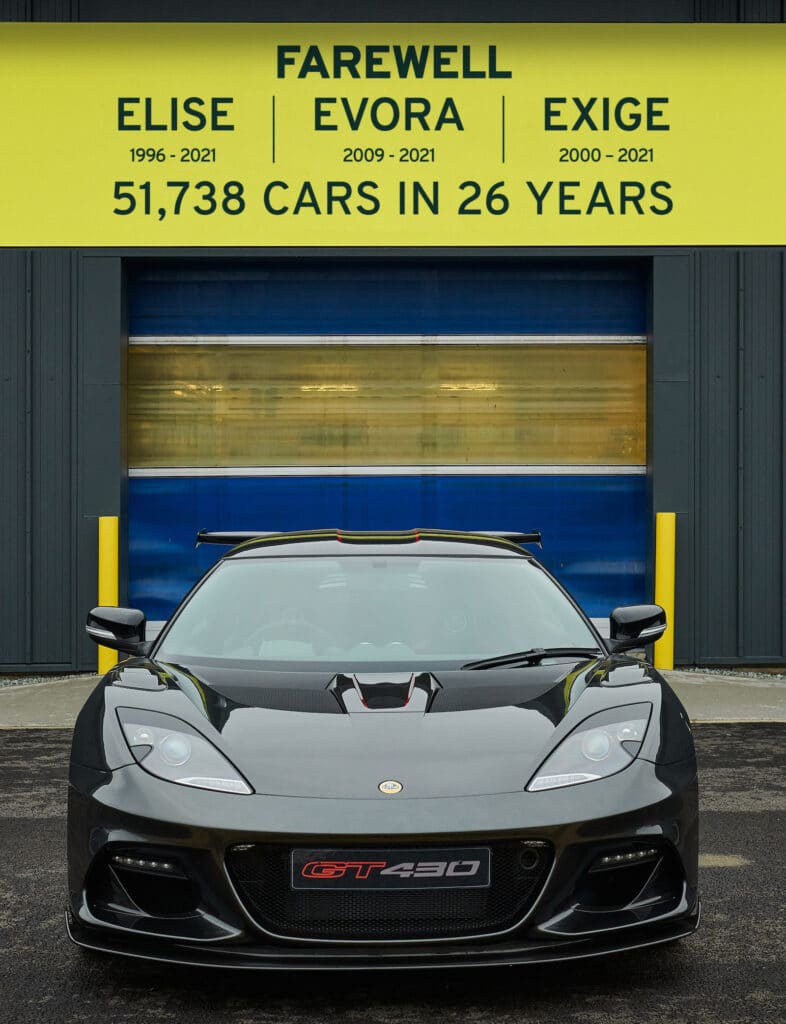

The final cars will be a yellow Elise Sport 240 Final Edition, the last of 35,124 cars; a Heritage Racing Green Exige Cup 430 Final Edition, the last of 10,497; and a Dark Metallic Grey Evora GT430 Sport, the last of 6,117 built.

The Evora is the only Lotus model currently sold in the United States, with a base price of $99,150. Its supercharged Toyota 3.5-liter V-6 makes 416 horsepower and 317 pound-feet of torque with the 6-speed manual transmission, or 332 lb-ft with the 6-speed automatic.

The final models of the Elise, Exige and Evora models will not be sold. They will be placed in Lotus’ heritage collection.

“(C)ustomers have given our ‘three Es’ true cult status — usually reserved for long-out-of-production classics,” said Matt Windle, managing director, Lotus Cars. “As we say farewell to the last few cars, we look forward to the Emira and Evija.”

The end of production coincides with the recent death of Hazel Chapman, wife of Lotus co-founder Colin Chapman.

What’s ahead for Lotus

The three models are being replaced by the all-new Emira, its name derived from ancient languages meaning “commander” or “leader.” The car will be Lotus’ last gasoline-powered sports car, with a design inspired by the Evija. All future models are promised to be 100% electric powered. Like previous Lotus models, the Emira will employ lightweight construction and massive horsepower, with a bonded aluminum chassis that’s strong, yet lightweight.

It will house one of two engines, the first being an AMG-tuned turbocharged 4-cylinder mated to a dual-clutch gearbox that sends 360 hp to the rear wheels. The other is a supercharged Toyota V-6 with either an automatic transmission or a 6-speed manual. The AMG engine will not be offered with a manual.

The company is also planning to release the Evija, a new hypercar and its first electric model. Punching out nearly 2,000 hp through all four wheels, it promises a 0-186 mph time of 9 seconds, making it the quickest vehicle on the road. But expect to pay $2 million for the privilege.

But that’s just the start of a line of new Lotus EVs that will include the Type 132 electric crossover, recently teased at the 2021 Gangzhou Auto Show as well as on YouTube. It’s also slated to be released in the Spring. The company is also planning to release the Type 131, the first of Lotus’s three new electric sports cars.

Group Lotus is owned by Chinese automaker Geely, which bought the British automaker in 2017, and Etika Automotive, a Malaysian conglomerate, which owns the remaining 49 percent.